Writing a Will doesn't have to be complicated or expensive. This site provides a free and simple way to compose your own legal Will online in a few easy steps: Enter basic information (name, address, marital status, children) Name a Will Executor; Describe how you would like your assets to be distributed Writing your own will can feel daunting — that’s why we worked with the nation's top legal experts to create our interactive online will maker. Enter your information, and we'll create a last will and testament customized to your wishes. We also have other estate planning products available to help you get all your affairs in order Writing a will isn't the most pleasant of tasks. After all, by doing so you're not only acknowledging your own inevitable demise but actively planning for it. That might explain why so many adults avoid this cornerstone of estate planning. According to an AARP survey, 2 out of 5 Americans over the age of 45 don't have a blogger.com: Brett Widness

How to Write a Will | Write Your Own Will in 10 Easy Steps

Refresh your driving skills and you could save on auto insurance! Writing a will isn't the most pleasant of tasks. After all, by doing so you're not only acknowledging your own inevitable demise but actively planning for it. That might explain why so many adults avoid this cornerstone of estate planning. According to an AARP survey, 2 out of 5 Americans over the age of 45 don't have a will. But creating a will is one of the most critical things you can do for your loved ones.

Putting your wishes on paper helps your heirs avoid unnecessary hassles, writing your will, and you gain the peace of mind knowing that a life's worth of possessions will end up in the right hands. The laws governing wills vary from state to state. If you aren't familiar with them, consider consulting a knowledgeable lawyer or estate planner in your area.

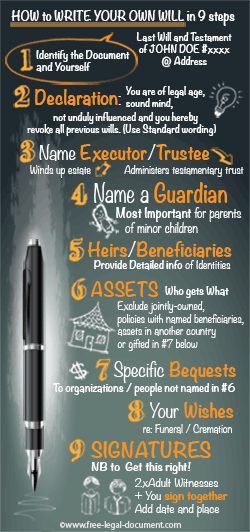

Before you do, brush up on these 10 things you should know about writing a will. What is a will? A will is simply a legal document in which you, the testatordeclare who will manage your estate after you die.

Your estate can consist of big, writing your will, expensive things such as a vacation home but also small items that might hold sentimental value such as photographs. The person named in the will to manage your estate is called the executor because he or she executes your stated wishes. A will can also serve writing your will declare who you wish to become the guardian for any minor children or dependents, and who you want to receive specific items that you own — Aunt Sally gets the silver, Cousin Billy the bone china, and so on.

Someone designated to receive any of your property is called a "beneficiary. Some types of property, including certain insurance policies and retirement accounts, writing your will, generally aren't covered by wills.

You should've listed beneficiaries when you took writing your will the policies or opened the accounts. Check if you can't remember, and make sure you keep beneficiaries up to date, since what you have on file when you die should dictate who receives those assets. If you die without a valid will, you'll become what's called intestate.

That usually means your estate will be settled based on the laws of your state that outline who inherits what. Probate is the legal process of writing your will the property of a deceased person to the rightful heirs. Since no executor was named, a judge appoints an administrator to serve in that capacity. An administrator also will be named if a will is deemed to be invalid. All wills must meet certain standards such as being witnessed to be legally valid, writing your will.

Again, requirements vary from state to state. An administrator will most likely be a stranger to you and your family, and he or she will writing your will bound by the letter of the probate laws of your state. As such, an administrator may make decisions that wouldn't necessarily agree with your writing your will or those of your heirs.

No, you aren't required to hire a lawyer to prepare your will, though an experienced lawyer can provide useful advice on estate-planning strategies such as living trusts.

But as long as your will meets the legal requirements of your state, it's valid whether a lawyer drafted it or you wrote it yourself on the back of a napkin. Do-it-yourself will kits are widely available.

Conduct an Internet search for "online wills" or "estate planning software" to find options, or check bookstores and libraries for will-writing guides.

Your state's departments of aging also might be able to direct you to free or low-cost resources for estate planning. And while you're working on your will, writing your will, you should think about preparing other essential estate-planning documents, writing your will.

Estate planners almost universally advise against joint wills, and some states don't even recognize them. Odds are you and your spouse won't die at the same time, and there's probably property that's not jointly held, writing your will. That's why separate wills make better sense, even though your will and your spouse's will might end up looking remarkably similar. In particular, separate wills allow for each spouse to writing your will issues such as ex-spouses and children from previous relationships.

Ditto for property that was obtained during a previous marriage. Be very clear about who gets what. Probate laws generally favor the current spouse. Any person can act as a witness to your will, but you should select someone who isn't a beneficiary. Otherwise there's the potential for a conflict of interest. The technical term is a disinterested witness, writing your will.

Some states require two or more witnesses, writing your will. If a lawyer drafts your will, he or she shouldn't serve as a witness. Not all states require a will to be notarized, but some do. You may also want to have your witnesses sign what's called a self-proving affidavit in the presence of a notary. This affidavit can speed up the probate process because your witnesses likely won't be called into court by a judge to validate their signatures and the authenticity of the will.

You can name your spouse, an adult child, or another trusted friend or relative as your executor. If your affairs are complicated, it might make more sense to name an attorney or someone with legal and financial expertise.

You can also name joint executors, such as your spouse or partner and your attorney. One of the most important things your will can do is empower your executor to pay your bills and deal writing your will debt collectors, writing your will. Make sure the wording of your will allows for this, and also gives your executor leeway to take writing your will of any related issues that aren't specifically outlined in your will.

If you wish to leave certain personal property to certain heirs, indicate as much in your will. In addition, you can create a separate document called a letter of instruction that you should keep with your will. A letter of instruction, which isn't legally binding in some states, can be written more informally than a will and can go into detail about which items go to whom.

You can also include specifics about any number of things that will help your executor settle your estate including account numbers, passwords and even burial instructions.

Another option is to leave everything to one trusted person who knows your wishes for distributing your personal items.

This, of course, writing your will, is risky because you're relying on this person to honor your intentions without fail. Consider carefully. Where should I keep my will? A probate court usually requires your original will before it can process your estate, writing your will, so it's important to keep the document safe yet accessible. If you put the will in a bank safe deposit box that only you can get into, your family might need to seek a court order to gain access.

A waterproof and fireproof safe in your house is a good alternative. Your attorney or someone you trust should keep signed copies in case the original is destroyed. Signed copies can be used to establish your intentions.

However, the absence of an original will can complicate matters, and without it there's no guarantee that your estate will be settled as you'd hoped. How often does a will need to be updated? It's possible that your will may never need to be updated — or you may choose to update it regularly. The decision is yours.

Remember, the only version of your will that matters is the most current valid one in existence at the time of your death. With that in mind, you may want to revisit your will at times of major life changes. Think of pivotal moments such as marriage, divorce, the birth of a child, the death of a beneficiary or executor, a significant purchase or inheritance, and so on. Your kids probably won't need guardians named in a will after they're adults, for example, but you might still need to name guardians for disabled dependents.

A rule of thumb: Review your will every two or three years to be safe. Who has the right to contest my will? Contesting a will refers to challenging the legal validity of all or part of the document. A beneficiary who feels slighted by the terms of a will might choose to contest it. Depending on which state you live in, so too might a spouse, ex-spouse or child who believes your stated wishes go against local probate laws. A will can be contested for any number of other reasons: it wasn't properly witnessed; you weren't competent when you signed it; or it's the result of coercion or fraud, writing your will.

It's usually up to a probate judge to settle the dispute. The key to successfully contesting a will is finding legitimate legal fault with it, writing your will. A clearly drafted and validly executed will is the best defense. You may also like: 5 tips for easing into retirement. Visit the AARP state page for information about events, news and resources near you.

You are leaving AARP. org and going to the website of our trusted provider. Please return to AARP. org to learn more about other benefits. You'll start receiving the latest news, benefits, events, and programs related to AARP's mission to empower people to choose how they live as they age. You can also manage your communication preferences by updating your account at anytime. You will be asked to register or log in.

In the next 24 hours, you will receive an email to writing your will your subscription to receive emails related to AARP volunteering.

Once you confirm that subscription, you will regularly receive communications writing your will to AARP volunteering. In the meantime, please feel free to search for ways to make a difference in your community at www. Javascript must be enabled to use this site. Please enable Javascript in your browser and try again. Share with facebook.

Eight Things NOT To Put In Your Will

, time: 11:30Writing Your Own Will - Script Writing Template | US Legal Forms

Writing a will isn't the most pleasant of tasks. After all, by doing so you're not only acknowledging your own inevitable demise but actively planning for it. That might explain why so many adults avoid this cornerstone of estate planning. According to an AARP survey, 2 out of 5 Americans over the age of 45 don't have a blogger.com: Brett Widness Simple steps for writing your own will: 1. Typically, when you write your own will you will start out with your name, residence, and also name any spouse or children. 2 Writing a Will doesn't have to be complicated or expensive. This site provides a free and simple way to compose your own legal Will online in a few easy steps: Enter basic information (name, address, marital status, children) Name a Will Executor; Describe how you would like your assets to be distributed

No comments:

Post a Comment